- Home

- Solutions

SOLUTIONS

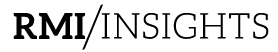

Enabling Accountants To Perform CFO Advisory Services In A Standardized Automated FashionEmpowering SMBs With Corporate Strategy & FP&A SoftwareGiving Superpowers To CFOsAutomating Repetitive Workflows For Self-Side Analysis, Investors, Lenders & Asset Managers - Product Tour

- About

- Contact